The projected future path of labor productivity in the U.S. is perhaps the most important input to the projected future path of GDP in the U.S. There are lots of estimates floating around, many of them pessimistic in the sense that they project labor productivity growth to be relatively slow (say 1.5-1.8% per year) over the next few decades compared to the relatively fast rates (roughly 3% per year) seen from 1995-2005. Robert Gordon has laid out the case for low labor productivity growth in the future. John Fernald has documented that this slowdown probably pre-dates the Great Recession, and reflects a loss of steam in the IT revolution starting in about 2007. This has made Brad DeLong sad, which seems like the appropriate response to slowing productivity growth.

An apparent alternative to that pessimism was published recently by Byrne, Oliner, and Sichel. Their paper is titled "Is the IT Revolution Over?", and their answer is "No". They suggest that continued innovation in semi-conductors could make possible another IT boom, and boost labor productivity growth in the near future above the pessimistic Gordon/Fernald rate of 1.5-1.8%.

I don't think their results, though, are as optimistic as they want them to be. A different way of saying this is: you have to work really hard to make yourself optimistic about labor productivity growth going forward. In their baseline estimate, they end up with labor productivity growth of 1.8%, which is slightly higher than the observed rate of 1.56% per year from 2004-2012. To get themselves to their optimistic prediction of 2.47% growth in labor productivity, they have to make the following assumptions:

- Total factor productivity (TFP) growth in non-IT producing non-farm businesses is 0.62% per year, which is roughly twice their baseline estimate of 0.34% per year, and ten times the observed rate from 2004-2012 of 0.06%.

- TFP growth in IT-producing industries is 0.46% per year, slightly higher than their baseline estimate of 0.38% per year, and not quite double the observed rate from 2004-2012 of 0.28%

- Capital deepening (which is just fancy econo-talk for "build more capital") adds 1.34% per year to labor productivity growth, which is one-third higher than their baseline rate of 1.03% and, and double the observed rate from 2004-2012 of 0.74%

The only reason their optimistic scenario doesn't get them back to a full 3% growth in labor productivity is because they don't make any optimistic assumptions about labor force quality/participation growth.

Why these optimistic assumptions in particular? For the IT-producing industries, the authors get their optimistic growth rate of 0.46% per year by assuming that prices for IT goods (e.g. semi-conductors and software) fall at the fastest pace observed in the past. The implication of very dramatic price declines is that productivity in these sectors must be rising very quickly. So essentially, assume that IT industries have productivity growth as fast as in the 1995-2005 period. For the non-IT industries, they assume that faster IT productivity growth will raise non-IT productivity growth to it's upper bound in the data, 0.62%. Why? No explanation is given. Last, the more rapid pace of productivity growth in IT and non-IT will induce faster capital accumulation, meaning that its rate rises to 1.34% per year. This last point is one that comes out of a simple Solow-type model of growth. A shock to productivity will temporarily increase capital accumulation.

In the end here is what we've got: they estimate labor productivity will grow very fast if they assume labor productivity will grow very fast. Section IV of their paper gives more detail on the semi-conductor industry and the compilation of the price indices for that industry. Their narrative explains that we could well be under-estimating how fast semi-conductor prices are falling, and thus under-estimating how fast productivity in that industry is rising. Perhaps, but this doesn't necessarily imply that the rest of the IT industry is going to experience rapid productivity growth, and it certainly doesn't necessarily imply that non-IT industries are going to benefit.

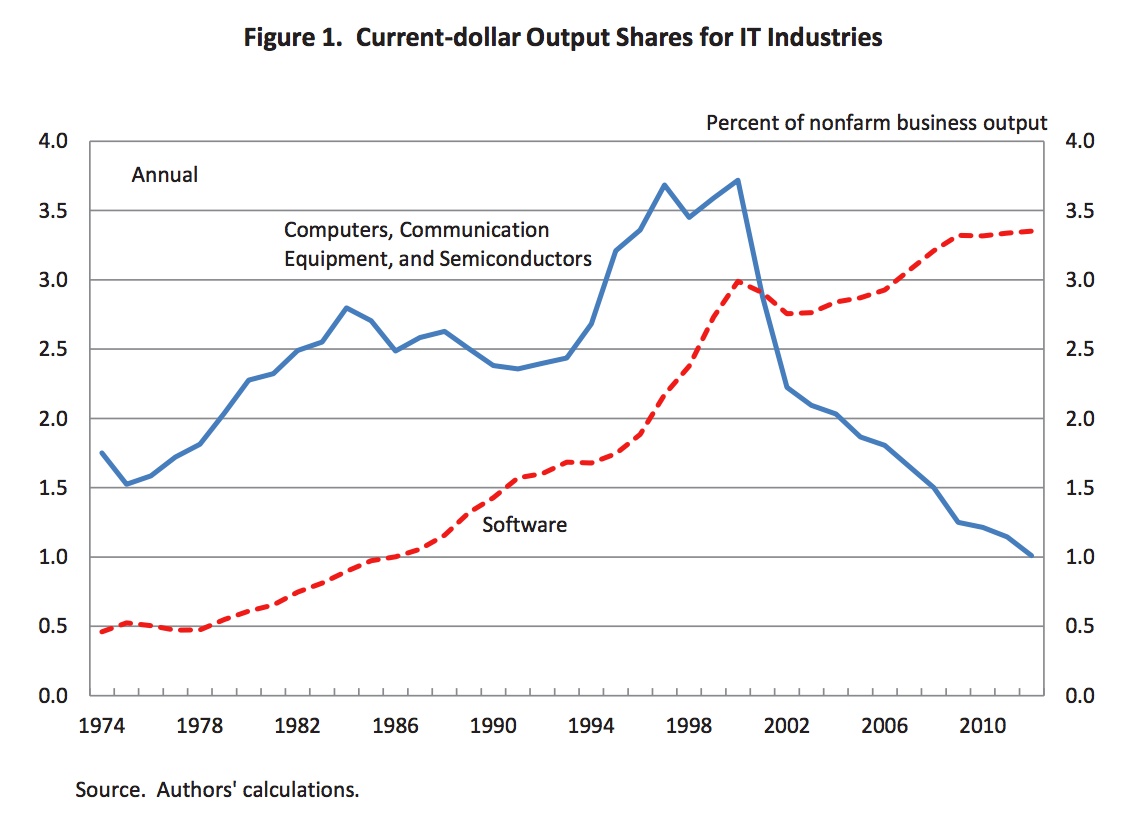

Further, even rapid growth in productivity in the semi-conductor industry is unlikely to create any serious boost to US productivity growth, because the semi-conductor industry has a shrinking share of output in the U.S. over time. The above figure is from their paper. The software we run is a booming industry in the U.S., but the chips running that software are not, and this is probably in large part due to the fact that those chips are made primarily in other countries. If you want to make an optimistic case for IT-led productivity growth in the U.S., you need to make a software argument, not a hardware argument.

I appreciate that Byrne, Oliner, and Sichel want to provide an optimistic case for higher productivity growth. But that case is just a guess, and despite the fact that they can lay some numbers out to come up with a firm answer doesn't make it less of a guess. Put it this way, I could write a nearly exact duplicate of their paper which makes the case that expected labor productivity growth is only something like 0.4% per year simply by using all of the lower bound estimates they have.

Ultimately, there is nothing about recent trends in labor productivity growth that can make you seriously optimistic about future labor productivity growth. But that doesn't mean optimism is completely wrong. That's simply the cost of trying to do forecasting using existing data. You can always identify structural breaks in a time series after the fact (e.g. look at labor productivity growth in 1995), but you cannot ever predict a structural break in a time series out of sample. Maybe tomorrow someone will invent cheap-o solar power, and we'll look back ten years from now in wonder at the incredible decade of labor productivity growth we had. But I can't possibly look at the existing time series on labor productivity growth and get any information on whether that will happen or not. Like it or not, extrapolating current trends gives us a pessimistic growth rate of labor productivity. Being optimistic means believing in a structural break in those trends, but there's no data that can make you believe.