A relatively quick post to highlight two other posts that recently came out regarding GDP growth. First, David Papell and Ruxandra Prodan have a guest post up at Econbrowser regarding the long-run effects of the Great Recession. They use the CBO projections of GDP into the future (similar to what I did here) and look at whether there was a statistically significant break in the level of GDP at the Great Recession. Short answer, yes. Their testing finds that the break was 2008:Q2, not a surprising date to end up with.

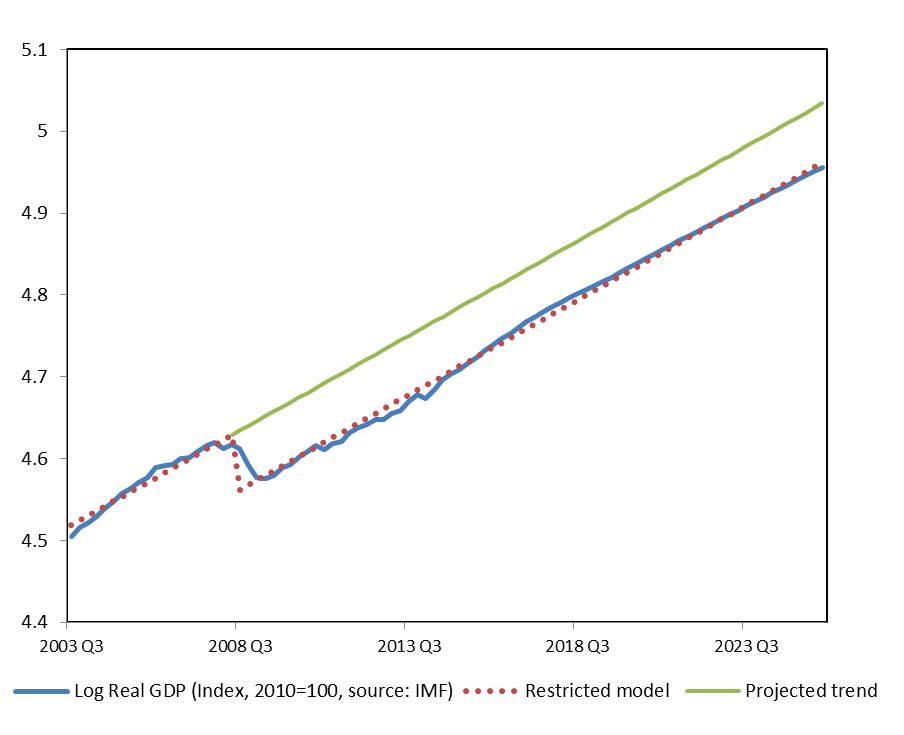

It is important to remember that David and Ruxandra are testing for a break in the level of GDP, and not GDP per capita. It is entirely possible to have a structural break in GDP while not having a structural break in GDP per capita. The next thing to remember is that they cannot reject that the growth rate of GDP is the same after 2008:Q2 as it was before. What I mean is easier to see in their figure than it is to explain:

Before and after the break, the growth rate is identical. It is just the level that has changed.

The second post is from Juan Antolin-Diaz, Thomas Drechsel, and Ivan Petrella. They use only existing data (not CBO projections) and find that there is statistical evidence of a change in the growth rate of U.S. GDP. They see a slowdown in growth starting in the mid-2000's, consistent with John Fernald's suggestions regarding productivity growth. It takes until 2015 to see this break statistically because you need several years of data to confirm that the growth slowdown was not a temporary phenomenon.

Note the subtle but very, very, very important difference between the two posts. Papell/Prodan find a significant shift in the level of GDP, while Antolin-Diaz, Drechsel, and Petrella (ADP) find a significant shift in the growth rate of GDP. The former sucks, but the latter is far more troubling. If the growth rate is truly lower, then we will get farther and farther away from the pre-GR trend, and the ratio of actual GDP to pre-GR trend GDP will go to zero. If it is just a level shift, then the ratio of actual GDP to pre-GR trend GDP will go to one as both become arbitrarily large.

I find the Papell/Prodan result more convincing. Keep in mind that David is my department chair and if I knocked on my office wall right now I could interrupt the phone call he is on. Ruxandra's office is all of 20 feet from mine. I see these people every day. But regardless of the fact that I know them personally, I think they are right.

ADP are getting a false result showing slow growth because of the level shift that David and Ruxandra identify. If ADP do not allow for the level shift, then over any window of time that includes 2008:Q2 the growth rate will be calculated to be low. But that is just a statistical artifact of this one-time drop in GDP. It doesn't mean that the long-run growth rate is in fact different. Put it this way: if they re-run their tests 25 years from now, they'll find no statistical evidence of a growth change.

Of course, if the CBO is wrong about the path of GDP from 2015-2025, then Papell/Prodan could be wrong and ADP could be right. But given the current CBO projections, there is strong evidence of a negative level shift to GDP, but no change in the long-run growth rate.