Productivity as a non-rival input

Rival and non-rival inputs

We know that productivity is important to the process of growth. It determines both the growth rate, $g_A$, along a BGP, and the baseline level, $A_0$, is part of what determines the level of the BGP. But what is productivity, and what makes it so important?

To answer these questions, we need to start by thinking more about the other inputs to production: labor and capital. Both of these are the kinds of things we typically have in mind when we think about economics. They are scarce, and their allocation depends on an interaction of people willing to supply their labor and capital to firms who have a demand for it.

A crucial feature of capital and labor is that they are rival inputs. Rivalry means that an input (or any good) can only be used or employed doing one thing at a time. Your time is a rival input to production. If you are working at Chevron, you can’t also be working at Shell at the same time. Capital is a rival input. The computer you’re reading this Study Guide on cannot be used by someone else to play Halo at the same time. We haven’t focused on natural resources as inputs yet, but natural resources are rival inputs. Once you burn some natural gas, it’s gone. This property extends to goods beyond inputs. A taco is a rival good. If I eat it, you cannot also eat it.

One way of thinking about rivalry is that it means that an input has an opportunity cost. If a firm hires a worker, they are spending money to pay that person and cannot hire someone else, or use that money to buy new desks or office chairs.

If rivalry makes sense as a concept, then what about its opposite, non-rivalry? Something that is non-rival is not limited to being used by one person at one time, or in one place at one time. Alternatively it can be used without using it up. Something non-rival doesn’t have an opportunity cost.

What’s an example of something non-rival? A recipe. The knowledge of how to combine flour, eggs, sugar, and milk into a cake is non-rival, even though the ingredients themselves are rival inputs. If you decide to bake a cake, that doesn’t prevent me from using the same recipe to bake a cake. I’d need my own ingredients, but the idea of how to combine those ingredients isn’t “used up” because you decided to make a cake. Both of us can use the same recipe at the same time. You can use the recipe over and over again without using it up.

Ideas, recipes, plans, blueprints, market research, specs, and the like are all non-rival inputs to production. They tell us how to combine the rival inputs capital and labor to produce goods and services. And that gets us to a definition of productivity.

Productivity is the set of non-rival ideas that tell us how to combine rival inputs (capital, labor) to produce GDP.

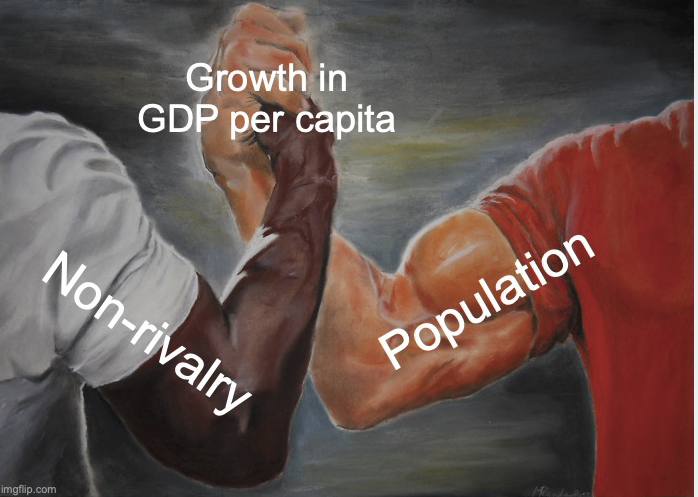

The non-rivalry is why productivity is capable of driving growth in GDP per person even when rival inputs (capital, labor) are not. Before we get to that, though, it is useful to think about a specific example to make the concepts clear.

Toyota

Watch the following clip about Toyota and the introduction of just-in-time inventory and “lean manufacturing”. Pay attention to how the video describes their innovations. Toyota used new ideas about how organize production (including borrowing an idea from grocery stores) to use their rival inputs (rubber, steel, labor) more efficiently. In other words, they used ideas to produce more using fewer rival inputs. That’s productivity.

Notice at the end (around the 4 minute mark) that the video explicitly discussed how other firms use the same principles as Toyota to be more efficient. Boeing, Intel, and hundreds of other companies learned or adopted the ideas from Toyota. And despite that, Toyota was still able to continue using those same techniques. Just-in-time inventory and lean manufacturing are non-rival ideas, and so the fact that Boeing uses them does not prevent Toyota (or Intel or anyone else) from using them.

Non-rivalry, scale, and growth

The Toyota example shows that ideas can enhance productivity of all the rival inputs in the world. That’s the importance of non-rivalry for growth. If I create a new non-rival idea (like the inventory system) I can apply that idea to any and all the production processes in the economy. That non-rival idea can raise the productivity of all the rival inputs in the economy.

If I create a rival capital good (like a robot) then I can use that capital input at one production location. The rival input makes a few workers more productive, and perhaps raises the productivity of other robots in the same factory, but that’s it. Increasing the amount of rival inputs doesn’t have the same power to increase GDP.

In terms of our production function

\[Y_t = K_t^{\alpha} (A_t L_t)^{1-\alpha}\]we said that $K_t$ and $L_t$ are the rival inputs, and now we’re saying that productivity, $A_t$, is a non-rival input. If you go back to when we introduced the production function you’ll see that one of the properties was that the production function was constant returns to scale with respect to capital and labor. What that really means is that the production function is constant returns to scale with respect to rival inputs.

Constant returns to rival inputs means that if I were to double capital and labor, I’d double GDP. Let’s just confirm that,

\[(2K_t)^{\alpha} (A_t 2 L_t)^{1-\alpha} = 2^{\alpha} 2^{1-\alpha} K_t^{\alpha} (A_t L_t)^{1-\alpha} = 2 K_t^{\alpha} (A_t L_t)^{1-\alpha}.\]Yes, if I double the use of capital and labor, I get twice as much GDP as I had before. That’s constant returns to scale. Notice that when I do this, the per-person GDP is the same as it was before. I doubled the people, I doubled the GDP, so GDP per person is the same.

Non-rivalry drives growth because it is not part of the constant returns to scale. What happens to GDP if I double the rival inputs capital and labor and I double non-rival productivity? Then we get

\[(2K_t)^{\alpha} (2 A_t 2 L_t)^{1-\alpha} = 2^{\alpha} 2^{1-\alpha} 2^{1-\alpha} K_t^{\alpha} (A_t L_t)^{1-\alpha} = 2^{2-\alpha} K_t^{\alpha} (A_t L_t)^{1-\alpha}.\]Since the number $\alpha$ is usually around 0.3, this means that doubling rival inputs and non-rival productivity raises GDP by a factor of $2^{2-.3} = 2^{1.7} = 3.25$. GDP goes up by a factor over three! Note that this means GDP per capita has gone up as well. GDP went up by 3.25, but the number of people only doubled, so GDP per capita was 3.25/2 = 1.625 times higher than before. Non-rival productivity allows us to grow per-capita GDP in a way that rival inputs cannot.

It is this ability of non-rival productivity to break out of the constraints of the constant returns to scale associated with rival inputs that allows for economic growth.

Thinking more deeply

The concept that non-rivalry was the origin of economic growth was articulated in the most coherent way by economist Paul Romer, who recently won a Nobel Prize for that work. The following video is his Nobel lecture explaining his idea. It ranges a bit farther than what we’ve talked about here, but remains a valuable introduction to thinking about the deeper reasons for economic growth.